Friday, May 04, 2001

Friday, May 04, 2001

Public Advocate Mark Green urged the city yesterday to establish educational programs for firefighting at two high schools and two community colleges to increase the number of minority group members in the FDNY.

In a city where minority groups now represent the majority of the population, the Fire Department remains overwhelmingly white and male.

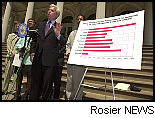

Mark Green at yesterday’s press conference on minorities in the FDNY

Mark Green at yesterday’s press conference on minorities in the FDNY

In a letter to Fire Commissioner Thomas Von Essen, Green, a Democratic mayoral hopeful, released statistics showing that blacks and Latinos make up 7% of the FDNY, as compared with 40% in Los Angeles’ fire department, 29% in Chicago and 30% in Philadelphia.

In 1999, blacks and Latinos accounted for 22% of those who took the firefighter exam and 18% of those who passed.

Green also said more needs to be done to increase the number of women in the department.

Currently, women represent less than 1% of the FDNY workforce.

The city “needs to create a pipeline of qualified minority and women applicants,” he said.

“The best way to permanently change the applicant pool is … to create at least two citywide high schools for fire sciences and a minimum of two fire science programs at CUNY,” Green added.

Mayor Giuliani’s office had no comment. In another development yesterday, about 30 demonstrators rallied outside FDNY headquarters in downtown Brooklyn to oppose firefighter candidate Police Officer Edward McMellon.

A handful of Muslim firefighters and their supporters oppose the possible hiring of McMellon because he was one of four cops who gunned down unarmed African immigrant Amadou Diallo in his Bronx vestibule in February 1999.

“Why does the fire commissioner want to hire McMellon to become a firefighter and save lives after he took my son’s life?” Diallo’s father, Saikou, said at the rally.

The group also demanded that the department hire a Muslim chaplain. FDNY Islamic Society President Kevin James noted that the agency has two Jewish, two Protestant and three Catholic chaplains, but no Muslims.